The FIAP Framework

Stakeholders

A FIAP is an organisation wide plan and therefore should aim to identify actions which will better serve and address the needs of four main stakeholder groups:

FIAP Action Areas

FIAP Actions are categorised into four action areas:

Products and Services

Provide fair, affordable and accessible products and services.

Financial Capability

Foster organisational culture to enhance financial capability of staff, customers and the community.

Understanding of Financial Vulnerability

Investigate, advocate and collaborate for improved responses to financial vulnerability.

Economic Security

Remove barriers and provide opportunities for economic security, equality, and growth.

Outcomes – Theory of Change

All FIAP Actions are mapped into a Theory of Change developed in conjunction with CSI UNSW.

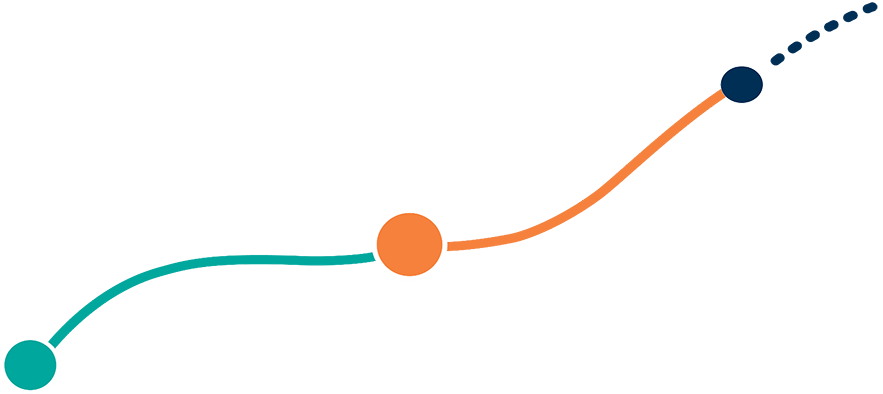

The FIAP Journey

There are three FIAP levels that an organisation progresses through on their financial inclusion journey.

Foundation

The first step is a 12-month commitment to deepening your organisation’s understanding of issues related to financial hardship and resilience; and to explore what your role is in promoting financial wellbeing amongst the stakeholders of your organisation.

The Foundation FIAP is broad in focus and allows an organisation to identify actions aligned to its business strategy and sphere of influence, act and learn; and critically, begin to build organisation capacity to do this work.

Build

With a longer timeframe of 2-3 years, a Build FIAP allows your organisation to reflect on the actions taken as part of the Foundation FIAP, and to explore further your unique vision for promoting financial inclusion.

With an increased focus on measurable outcomes, what will become business as usual as part of your organisation’s strategy? Where would the organisation like to stand out and take a leadership role in helping to promote financial wellbeing in Australia?

Extend

At the final level, the Extend FIAP is for organisations that have established a strong internal approach towards promoting financial wellbeing and are ready to take a leadership role in advocating for and influencing broader systems change to promote financial wellbeing in Australia.

'Foundation' FIAP: The First Step

Organisations joining the FIAP program start with a Foundation FIAP. Good Shepherd works with new members to identify current actions to improve financial inclusion and wellbeing, and develop a twelve-month commitment to action based on this starting point. These plans will often include actions aimed at improving responses to customer vulnerability, increase staff awareness and understanding, and identify gaps that can be addressed in future plans.

Become a new FIAP Member

Learn about financial wellbeing and be part of a vibrant community dedicated to improving it.

'Build' FIAPs: Leadership Actions and Core Commitments

Build FIAPs have a timeframe of 2-3 years, with annual progress verification. Actions are developed with the long-term outcome of financial wellbeing in mind. Build FIAPs have two components: Core Commitments and Leadership Actions

Core Commitments

-

Actions that you commit to embed into your future business as usual practice.

-

Can be existing, changed, or new actions.

-

Must detail specific actions to support Core Commitments.

-

Choose actions across existing categories in each of the 4 FIAP Action Areas

Leadership Actions

-

Deeper commitments that extend financial inclusion beyond the Core Commitments.

-

Key communication tool – actions that lend themselves to case studies or stories. Must have clear targets and metrics.

-

Must commit to measurement over the FIAP period, in case data is not available at the start of Build FIAP.

Build FIAPs - Core Commitments

Organisations starting a Build FIAP use the following Core Commitments as a guide to develop their actions.

Provide fair, affordable, and accessible products and services.

Develop and communicate Hardship Policies and Frameworks that meet the needs of staff, customers and community.

Encourage savings and the creation of savings buffers through product design and delivery

Offer or support affordable, accessible and appropriate credit products for people on low incomes

Offer or support affordable, accessible and appropriate insurance products

Develop and implement programs to encourage appropriate consumption, spending, and usage

Develop and implement programs that address barriers to access faced by those experiencing financial vulnerability

Develop and implement systems that allow for early identification and intervention to avoid financial hardship

Provide products and services targeted for the needs of specific groups, i.e. for people with a disability, mental health, elderly, Indigenous, culturally diverse, remote, or those who are digitally excluded

Ensure general product and service information is communicated to vulnerable groups

Foster organisational culture to enhance financial capability of staff, customers and the community.

Develop and implement programs for staff to increase understanding of personal financial inclusion and wellbeing

Provide programs to enhance the financial capability of customers, suppliers and community, especially those who are financially vulnerable

Partner with external organisations that enhance financial capability in the community (e.g., financial counsellors, community organisations)

Provide programs that aim to influence behaviour for increased financial wellbeing

Investigate, advocate and collaborate for improved response to financial vulnerability

Collaborate and support evidence-based approaches that add to the broader knowledge base and understanding of financial vulnerability

Develop and implement programs to increase staff understanding of customers’ financial vulnerability

Use evidence-based approaches that incorporate an understanding of financial vulnerability to impact decision making

Advocate for broader awareness and understanding of financial vulnerability

Develop and implement complementary action plans (e.g., Reconciliation, Diversity) that address issues of financial inclusion and wellbeing for targeted groups

Engage and collaborate with other stakeholders, including community organisations, to identify appropriate pathways and tools for support for vulnerable groups

Remove barriers and provide opportunities for economic security, equality, and growth

Offer services to support the economic security of staff who may experience financial vulnerability

Offer direct employment programs that address the needs of financially vulnerable groups

Support programs that increase employment opportunities and support for those entering employment

Support education programs for people who may otherwise experience financial vulnerability

Develop and implement social procurement programs

Develop and implement programs that increase access to stable housing for financially vulnerable people

Promote economic equality (e.g., Superannuation policies for staff that address gender such as continuing to pay super during parental leave)